Today’s Bureau of Labor Statistics Employment Situation Summary (BLS) data has been eagerly anticipated by an unusually broad spectrum of audiences. Politicians are ready to interpret results to favor their candidate in the November presidential elections. The report on hiring and employment in August will be pivotal in shaping any Federal Reserve Bank interest rate adjustment later this month, and business leaders will be looking for clues on the overall trajectory of the economy as they make forward-looking investment decisions. The BLS report had a little something for everyone with what might be characterized as a “steady as she goes” report.

Today’s Bureau of Labor Statistics Employment Situation Summary (BLS) data has been eagerly anticipated by an unusually broad spectrum of audiences. Politicians are ready to interpret results to favor their candidate in the November presidential elections. The report on hiring and employment in August will be pivotal in shaping any Federal Reserve Bank interest rate adjustment later this month, and business leaders will be looking for clues on the overall trajectory of the economy as they make forward-looking investment decisions. The BLS report had a little something for everyone with what might be characterized as a “steady as she goes” report.

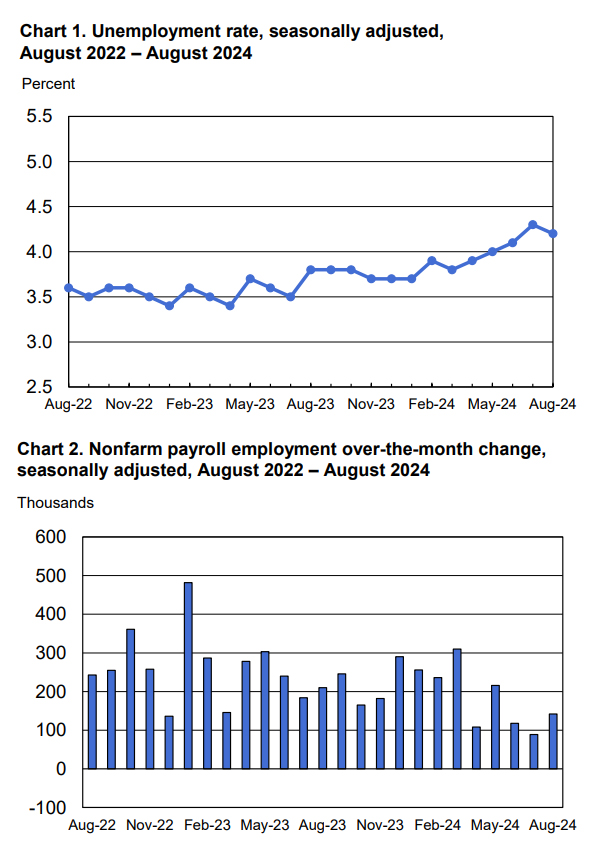

The BLS reported total nonfarm payroll employment increased by 142,000 in August, slightly below analysts’ expectations, while the unemployment rate changed little, easing back to 4.2 percent. Employment growth in August was in line with average job growth in recent months but was below the average monthly gain of 202,000 over the prior 12 months. While the August numbers were close to expectations, the previous two months saw substantial downward revisions. The BLS cut July’s total by 25,000, while June featured a downward revision of 61,000.

“As politicians and economic analysts pour over today’s jobs report to understand current job creation and unemployment trends, it might be useful to look below the surface data at critical factors reshaping today’s white collar employment landscape. Our MRINetwork of over 1000 talent consultants see both clients and candidates continuing to wrestle with one of the most contentious factors in U.S. workplace transformation, work-from-home versus full time return to the office,” noted Rick Hermanns, president and chief executive officer of HireQuest Inc., parent company of MRINetwork.

“Many of our clients point to internal studies that show a mixed bag of benefits and challenges generated by remote work as they search for the right balance of productivity growth, and employee retention and satisfaction levels. And many top performers that our consultants guide in their career development journey are often conflicted by the seeming trade-off of career advancement versus lifestyle advantages in a work-from-home environment.

Pew Research indicates that today over 42 percent of workers are working exclusively from home or are in a hybrid environment. While down from a Covid lockdown high of 71 percent, it’s apparent that a shift to remote work is not a temporary emergency measure. It’s a fact that the 64 percent of the 1,300 CEOs surveyed by KPMG who expect all workers will be back in office by 2026 will need to deal with. Don’t expect any one-size-fits-all resolution in the short term. As a top individual performer or as an innovative corporate organization, be prepared to adjust as the marketplace searches for the optimal workplace model.”

Wall Street Journal reporter David Uberti summarized the clarity the market was looking for in today’s numbers, “A month ago, the weaker-than-expected July hiring report rekindled fears of a slowdown. New claims for unemployment are elevated. Job openings have slipped. Wage gains are slowing. The streak of cool economic data startled Wall Street in early August and contributed to a global selloff that briefly thrust the record-breaking U.S. stock market into one of its most volatile periods in years.

The big question in recent weeks has been whether the summer jolt was momentary—perhaps a result of Hurricane Beryl curbing hiring—or evidence of a broader deceleration of the economy. Analysts are looking to Friday’s jobs report for clues.“

Reuters Lucia Mutikani’s analysis provided context to the seasonality factors associated with the August data, “U.S. employment increased less than expected in August, but a drop in the jobless rate to 4.2% suggested an orderly labor market slowdown continued and probably did not warrant a big interest rate cut from the Federal Reserve this month. The smaller-than-expected increase in payrolls likely does not signal a deterioration in labor market conditions. August payrolls have a tendency to initially print weaker relative to the consensus estimate and recent trend before being revised higher later. Hiring typically picks up in the education sector, which is anticipated by the model that the government uses to strip out seasonal fluctuations from the data.”

Key industries reported the following trends in August:

Construction employment rose by 34,000 in August, higher than the average monthly gain of 19,000 over the prior 12 months. Heavy and civil engineering construction added 14,000 jobs, and employment in nonresidential specialty trade contractors continued to trend up (+14,000).

Healthcare added 31,000 jobs in August, about half the average monthly gain of 60,000 over the prior 12 months.

Employment in manufacturing edged down in August (-24,000), reflecting a decline of 25,000 in durable goods industries. Manufacturing employment has shown little net change over the year.

Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; wholesale trade; retail trade; transportation and warehousing; information; financial activities; professional and business services; leisure and hospitality; other services; and government.

“Work-from-home policies will continue to evolve as companies search for the right balance to increase productivity while bolstering overall employee retention.

Within this changing landscape however, our Network’s top talent advisors counsel aspiring high performers to focus not just on short-term benefits from remote work arrangements but on driving their career advancement and generating business growth for their organizations in a challenging new role,” noted Hermanns.

If you are interested in reading the HireQuest Inc. white paper entitled, Navigating Remote and Hybrid Work: Impacts on U.S. Companies and the Economy, share your information here to receive it.

Connect with MRINetwork