“Each week analysts look to the Department of Labor’s report on initial jobless claims to get a sense of labor market vitality leading up to the more widely covered monthly Employment Situation Summary data from the Bureau of Labor Statistics (BLS). So far in 2025, new weekly unemployment claims figures have stayed in a narrow range, indicating that the economy hasn’t seen a significant uptick in layoffs. Today’s BLS data showing new job growth of 177,000 seems to confirm the weekly jobless claims data indicating that despite recent pessimistic economic sentiment the U.S. jobs market remains resilient.

“Each week analysts look to the Department of Labor’s report on initial jobless claims to get a sense of labor market vitality leading up to the more widely covered monthly Employment Situation Summary data from the Bureau of Labor Statistics (BLS). So far in 2025, new weekly unemployment claims figures have stayed in a narrow range, indicating that the economy hasn’t seen a significant uptick in layoffs. Today’s BLS data showing new job growth of 177,000 seems to confirm the weekly jobless claims data indicating that despite recent pessimistic economic sentiment the U.S. jobs market remains resilient.

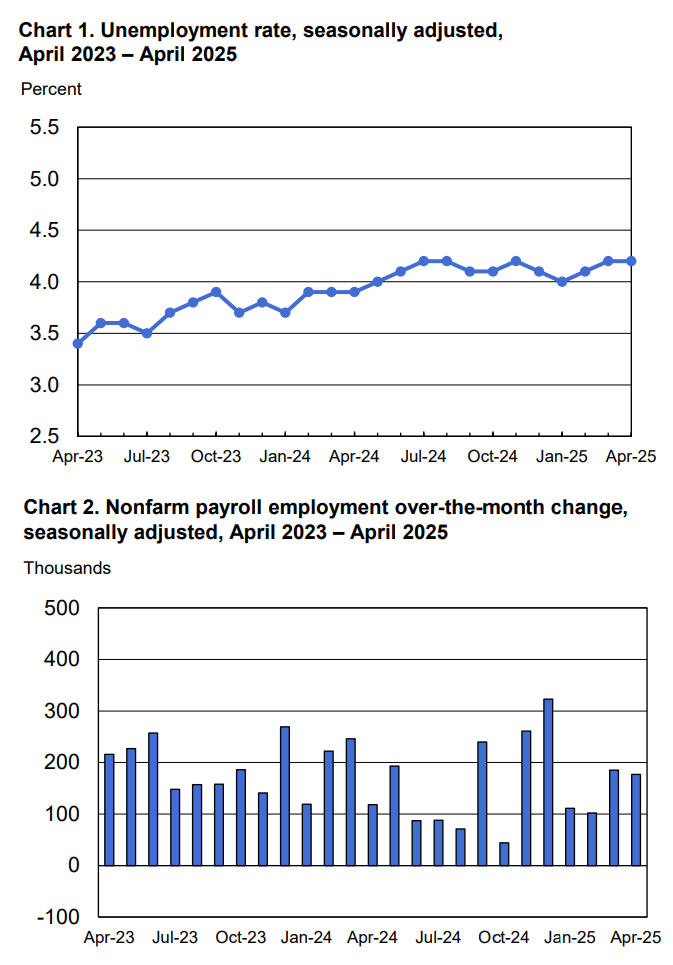

The BLS reported both the unemployment rate, at 4.2 percent, and the number of unemployed people, at 7.2 million, changed little in April. The unemployment rate has remained in a narrow range of 4.0 percent to 4.2 percent since May 2024,” noted Rick Hermanns, president and chief executive officer of HireQuest.

“With economic uncertainty ahead, our franchise owners—spanning more than 450 offices globally—are encouraging clients to stay alert and adaptable. The Wall Street Journal recently highlighted job growth in niche roles like data center technicians, wind turbine service techs, and healthcare positions such as imaging and therapy staffing. We encourage both clients and candidates to explore opportunities in these fast-growing sectors, where demand continues to outpace supply. In dynamic times like these, businesses must lean into flexible staffing models. Skilled short-term talent isn’t just a stopgap—it’s a strategic advantage.”

Wall Street Journal investing columnist, Spencer Jakab provided broad labor market background to today’s BLS data, “The labor market certainly is looser than at that ‘name your price’ peak three years ago. In the spring and summer of 2022, the ratio of job openings to job seekers reached a historic high of two. This week’s report on the same data, which covered March, shows that ratio fell back to one. That’s still tight, though: The average this century has been around 0.7, points out DataTrek Research.” Mr. Jakab added a look forward reflecting general analyst sentiment, “So, all good? Not really. If tariffs stay at current levels much longer, the initial wave of U.S. job losses will move at the lumbering speed of a cargo ship and then a freight train as imported wares gradually become scarcer. Watch trucking and retail for early signs of labor stress.”

Adding to the theme of most analysts, Mark Zandi, chief economist at Moody’s Analytics had speculated prior to today’s report, “If it’s around 150,000 give or take, I think all will be forgiven. So, I think we’ll end the week feeling OK, not great, but OK. Things aren’t falling apart.”

Key industries reported the following trends in April 2025:

Healthcare added 51,000 jobs in April, about the same as the average monthly gain of 52,000 over the prior 12 months.

In spite of an expected slowdown, employment in transportation and warehousing increased by 29,000 in April, following little change in the prior month (+3,000). Job gains occurred in warehousing and storage (+10,000), couriers and messengers (+8,000), and air transportation (+3,000) in April. Transportation and warehousing had added an average of 12,000 jobs per month over the prior 12 months.

In April, financial activities employment continued to trend up (+14,000). The industry has added 103,000 jobs since its employment trough in April 2024.

Employment in social assistance continued its upward trend in April (+8,000) but at a slower pace than the average monthly gain over the prior 12 months (+20,000).

Within government, federal government employment declined by 9,000 in April and is down by 26,000 since January. (Employees on paid leave or receiving ongoing severance pay are counted as employed in the establishment survey.)

Employment showed little or no change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; retail trade; information; professional and business services; leisure and hospitality; and other services.

The BLS revised down total nonfarm payroll employment for February by 15,000, from +117,000 to +102,000, and March was revised down by 43,000, from +228,000 to +185,000. With these revisions, employment in February and March combined is 58,000 lower than previously noted.

“Our offices are individually owned by talent industry professionals. They have skin-in-the game and are committed to fostering long-term client relationships to help guide clients through tumultuous business cycles. Using broad toolsets ranging from executive recruitment to on-demand workforce solutions to much more focused solutions like candidate e-verification, our teams are ready to deliver effective workplace strategies to drive business growth in any business environment,” noted Hermanns.

Connect with MRINetwork