“Today’s Bureau of Labor Statistics report (BLS) underscores just how complex the labor market has become. Job creation has slowed, adding just 22,000 jobs in August. While reductions in immigrant labor might be a factor, in time, this may help mitigate the impact for other workers. Longer term, this shift could position the economy for stronger growth once the market firms up, as the 1.2 million immigrant workers who exited earlier this year will not be there to backfill future openings. That dynamic creates opportunity for U.S. workers and points to a tighter, more competitive labor environment when demand rebounds,” noted Rick Hermanns, president and chief executive officer of HireQuest (NASDAQ: HQI).

“Today’s Bureau of Labor Statistics report (BLS) underscores just how complex the labor market has become. Job creation has slowed, adding just 22,000 jobs in August. While reductions in immigrant labor might be a factor, in time, this may help mitigate the impact for other workers. Longer term, this shift could position the economy for stronger growth once the market firms up, as the 1.2 million immigrant workers who exited earlier this year will not be there to backfill future openings. That dynamic creates opportunity for U.S. workers and points to a tighter, more competitive labor environment when demand rebounds,” noted Rick Hermanns, president and chief executive officer of HireQuest (NASDAQ: HQI).

“At the same time, the Fed needs to act on rate changes sooner rather than later. We’re already seeing a backlog of large-scale projects sitting on the sidelines, waiting for financing conditions to improve. Once rates come down and those projects are greenlit, we expect a meaningful uptick in activity, and with it, stronger demand across the staffing industry.”

“We’ve also been watching the divergence in job numbers for some time. The Wall Street Journal flagged it last year, noting how BLS payroll data, JOLTS, and household surveys were increasingly out of sync. Economists have pointed to immigration changes as one explanation, but the reality is that the signals remain mixed. Some sectors are performing better than others, but the strengthening isn’t uniform, making it harder to read the market and plan ahead in staffing.”

CNBC’s Sean Conlon and Brian Evans provided a clear preview of today’s BLS numbers quoting Chris Larkin, managing director of trading and investing at E-Trade from Morgan Stanley, “The jobs report will be the deciding factor [regarding interest rate decisions], but so far this week the data is confirming a slowdown in the labor market. in the short-term, markets may embrace that data because it should increase the odds of Fed rate cuts. But if the numbers deteriorate too much, it could raise concerns about the health of the economy.”

Wall Street Journal reporter Rachel Louise Ensign characterized today’s data as a sign that the labor market is deteriorating markedly and noted the anticipated impacts on interest rate decisions, “Federal Reserve officials are increasingly concerned about weakness in the labor market, with Fed Chair Jerome Powell citing it as a potential reason to cut interest rates this year. Fed officials are scheduled to meet later this month. Powell has said the U.S. labor market has entered ‘a curious kind of balance,’ where both the supply of and demand for workers is slowing. Immigration restrictions are crimping the availability of workers, and companies are bolstering their results by holding down hiring and getting employees to work more efficiently.”

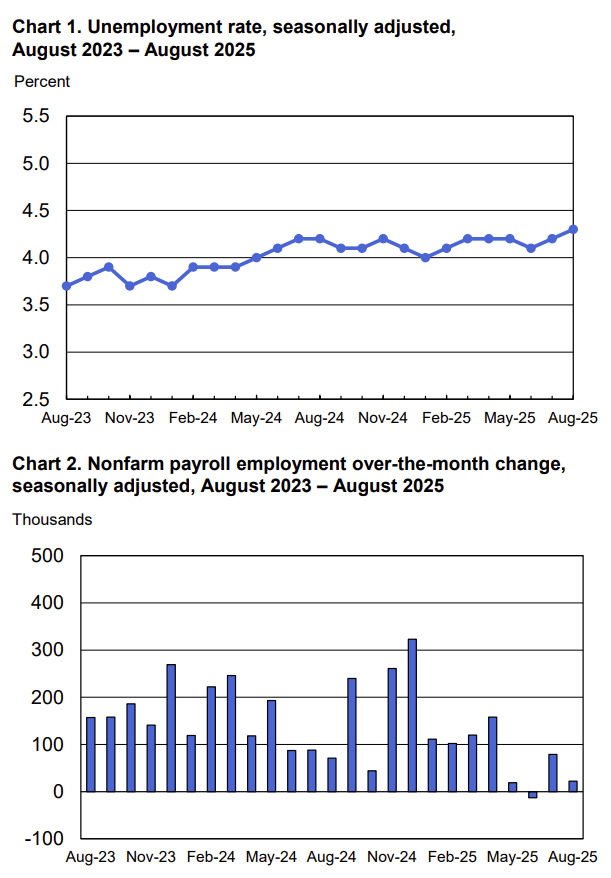

The BLS also revised its numbers from earlier in the summer indicating a loss of 13,000 jobs in June, the first such decline since December 2020.

Key industries reported the following trends in August 2025:

Total nonfarm payroll employment changed little, continuing a trend of tepid growth since April.

In August, healthcare added 31,000 jobs, below the average monthly gain of 42,000 over the prior 12 months. This gain was partially offset by losses in federal government and in mining, quarrying, and oil and gas extraction.

Employment in social assistance continued to trend up in August (+16,000), reflecting continued job growth in individual and family services (+16,000).

Federal government employment continued to decline in August (15,000) and is down by 97,000 since reaching a peak in January. As noted previously, employees on paid leave or receiving ongoing severance pay are counted as employed in the BLS establishment survey.

In August, employment in mining, quarrying, and oil and gas extraction declined by 6,000, after changing little over the prior 12 months.

Wholesale trade employment continued to trend down in August (12,000) and has fallen by 32,000 since May.

Manufacturing employment edged down in August (-12,000) and is down by 78,000 over the year. Employment in transportation equipment manufacturing declined by 15,000 over the month, in part due to strike activity.

Employment showed little change over the month in other major industries, including construction, retail trade, transportation and warehousing, information, financial activities, professional and business services, leisure and hospitality, and other services.

Connect with MRINetwork