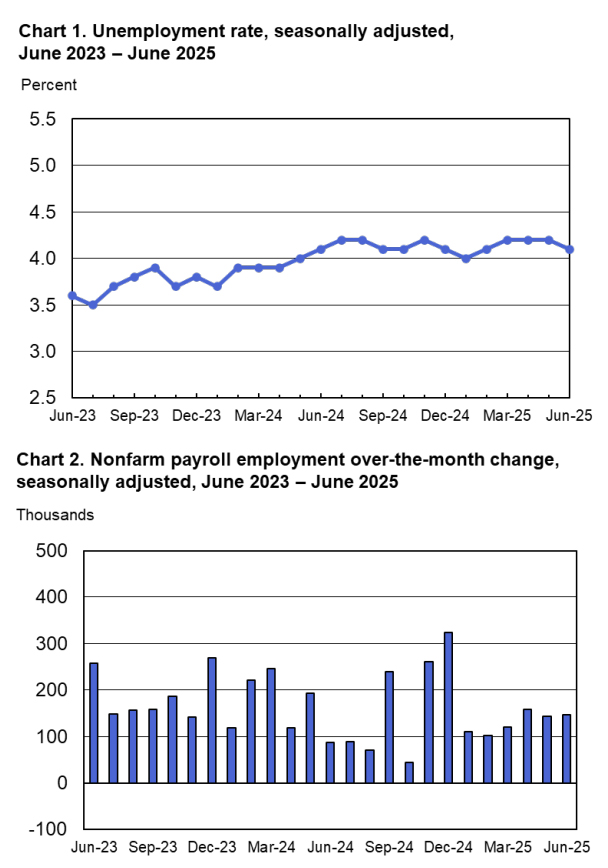

“Today’s U.S. Bureau of Labor Statistics Employment Situation Summary (BLS) report did not deliver any labor market fireworks. In spite of a portent mix of congressional mega-bill negotiations, global tariff discussions, Middle East uncertainties, and ongoing ICE immigration activities the BLS reported non-farm payrolls rose by 147,000 in June. This report is slightly above analysts’ expectations but in-line with the average monthly gain of 146,000 over the prior 12 months. Additionally, some experts had predicted significant revisions to April and May BLS data but earlier counts only ticked up by 16,000 jobs.

“Today’s U.S. Bureau of Labor Statistics Employment Situation Summary (BLS) report did not deliver any labor market fireworks. In spite of a portent mix of congressional mega-bill negotiations, global tariff discussions, Middle East uncertainties, and ongoing ICE immigration activities the BLS reported non-farm payrolls rose by 147,000 in June. This report is slightly above analysts’ expectations but in-line with the average monthly gain of 146,000 over the prior 12 months. Additionally, some experts had predicted significant revisions to April and May BLS data but earlier counts only ticked up by 16,000 jobs.

Both the unemployment rate, at 4.1 percent, and the number of unemployed people, at 7.0 million, changed little in June. The unemployment rate has remained in a narrow range of 4.0 percent to 4.2 percent since May 2024.

The labor market in our areas of specialization generally remains steady, although with some regional unevenness, across our network of over 450 offices. Importantly, our business model, emphasizing local franchised ownership, allows our divisions like HireQuest Direct and Snelling to pivot to meet specific needs in growing sectors such as event staffing. That sector has seen a 39% increase in year-over year growth the past quarter,” noted Rick Hermanns, president and chief executive officer of HireQuest, “and our leading MRINetwork executive search offices in areas like finance are seeing consistent demand. They have nimbly responded to a clear push by private equity to bring in tech-savvy talent, especially those with AI implementation skills delivering talent across a broad section of insurance and credit structuring businesses.

While our businesses can quickly respond to changing labor demands, it is essential that our political leaders on both sides of the aisle get serious in addressing the systemic problems built into the base of the current labor market. Our clients are whiplashed by policies that breed uncertainty. As I noted in recent comments to CNBC, ‘I’d rather have more lax or more strict enforcement; the uncertainty is worse. What needs to be done is for people from both camps to come together and realize what we have is unsustainable. The ripple effects of uncertainty are much deeper and broader than what anyone understands, candidly to me, our entire political establishment is unserious about looking at all of the effects.’ “

The Wall Street Journal’s initial read on this morning’s data noted the June jobs report showed the labor market expanded more than expected and unemployment fell. Stock futures gained, bond yields rose and the dollar strengthened. The WSJ also predicted Federal Reserve interest rate reduction expectations were less likely in the coming month. Reporter Caitlin McCabe observed that the report contrasts with surprisingly soft private-sector jobs data from ADP and positing that it will feed into debates about how the trade war is affecting the U.S. economy and whether the Federal Reserve should be cutting rates.

Key industries reported the following trends in June 2025:

A closely watched segment, government employment, rose by 73,000 in June. Employment in state government increased by 47,000, largely in education (+40,000). Job losses continued in federal government (-7,000), where employment is down by 69,000 since reaching a recent peak in January. Note that employees on paid leave or receiving ongoing severance pay are counted as employed in the BLS survey.

Healthcare added 39,000 jobs in June, similar to the average monthly gain of 43,000 over the prior 12 months. In June, job gains occurred in hospitals (+16,000) and in nursing and residential care facilities (+14,000).

In June, social assistance employment continued to trend up (+19,000), reflecting continued growth in individual and family services.

Employment in other major industries, primarily reflecting private sector jobs, showed little change over the month, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; retail trade; transportation and warehousing; information; financial activities; professional and business services; leisure and hospitality; and other services.

“Our franchise owners are highly skilled, client-focused talent professionals. The HireQuest business model encourages owners to pivot efficiently and lean into high-demand sectors as they source emerging candidate needs. While our unique structure positions 450 owners to focus on delivering innovative talent solutions, all of our offices and indeed the entire talent industry will benefit from a coherent well-articulated national immigration labor strategy,” noted Hermanns.

Connect with MRINetwork