“Analysts’ consensus for this month’s Bureau of Labor Statistics (BLS) Employment Situation Summary data was for continued job growth but at a slower pace than previous periods. Today’s data indicating 228,000 new jobs beat expectations, but these figures could quickly turn stale as next month’s data will likely reflect impacts from DOGE and the tariff impact on hiring and business investment plans.

“Analysts’ consensus for this month’s Bureau of Labor Statistics (BLS) Employment Situation Summary data was for continued job growth but at a slower pace than previous periods. Today’s data indicating 228,000 new jobs beat expectations, but these figures could quickly turn stale as next month’s data will likely reflect impacts from DOGE and the tariff impact on hiring and business investment plans.

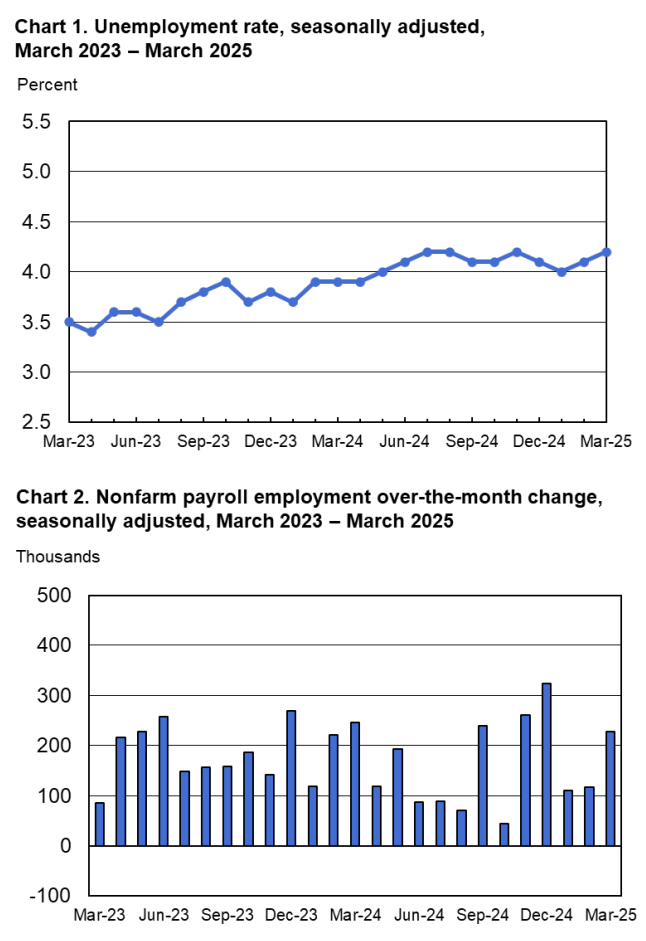

The BLS reported both the unemployment rate, at 4.2 percent, and the number of unemployed people, at 7.1 million, changed little in March. The unemployment rate has remained in a narrow range of 4.0 percent to 4.2 percent since May 2024. The bureau also updated nonfarm payroll employment for January and February. January was revised down by 14,000 and the change for February was revised down by 34,000. With these revisions, employment in January and February combined is 48,000 lower than previously reported,” noted Rick Hermanns, president and chief executive officer of HireQuest.

“While the BLS data was somewhat robust, the economic environment remains challenging as businesses assess possible impacts from the administrations emerging tariff and immigration enforcement policies as well as potential trickle-down impacts from DOGE initiatives.

Our staffing and executive recruitment businesses, led by franchise owners in over 450 offices throughout the U.S. are leveraging their talent consulting and delivery skills to help clients navigate this uncertain economic environment.

For example, in the construction industry our teams guide clients to embrace strategic workforce planning, staffing partnerships, and technological advancements, to help them effectively navigate the challenges posed by shifting immigration policies. We urge clients to proactively address labor shortages through education, automation, and improved job satisfaction to not only ensure project stability but also to attract the next generation of skilled workers.

And we continue to urge our clients in every industry to address an additional workforce challenge, the ongoing return to office versus remote work dilemma. While there is no one-size-fits-all answer many of our client’s find a balance with a win-win hybrid model that offers employees the flexibility they crave while pulling them into the office to experience valuable in-person relationships, the energy of face-to-face teamwork, and the advantages in-person engagement with valuable organic moments that foster opportunities to mentor and deepen organizational connections.”

Wall Street Journal reporter Harriet Torry provided observations by Sarah House, senior economist for Wells Fargo. Ms. House noted “The report offers relief about the labor market given recent concerns about growth, but while hiring was holding up in March, there’s a lot of new challenges ahead.” She also reported perspective by James Knightley, chief international economist at ING Financial Markets, “Three to four months ago, everyone was pretty upbeat; we thought Trump was going to turbocharge the economy with deregulation and tax cuts—and instead we’ve got austerity, trade protectionism and immigration controls.”

Adding context to today’s data CNBC reporter Jeff Cox quoted Lindsay Rosner, head of multi-sector fixed income investing at Goldman Sachs Asset Management, “Today’s better than expected jobs report will help ease fears of an immediate softening in the US labor market, however, this number has become a side dish with the market just focusing on the entrée: tariffs.”

Key industries reported the following trends in March 2025:

Healthcare added 54,000 jobs in March, in line with the average monthly gain of 52,000 over the prior 12 months and employment in social assistance increased by 24,000, higher than the average monthly gain of 19,000.

Retail trade added 24,000 jobs in March, as workers returning from a strike contributed to a job gain in food and beverage retailers (+21,000). General merchandise retailers lost 5,000 jobs. Employment in retail trade changed little over the year.

Employment in transportation and warehousing showed surprising resilience, increasing by 23,000 in March, almost double the prior 12-month average gain of 12,000.

Within government, federal government employment declined by 4,000 in March, following a loss of 11,000 jobs in February. The BLS added that federal employees on paid leave or receiving ongoing severance pay are counted as employed in the establishment survey.

Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; information; financial activities; professional and business services; leisure and hospitality; and other services.

“Business leaders must take a proactive approach to meeting the challenges of this unique business environment. It requires a thoughtful structured strategy to turn remote work conflicts into opportunities and to pro-actively manage a firm’s entire workforce to react to and leverage marketplace disruptions due to emerging tariff, immigration enforcement policies and DOGE related activities,” noted Hermanns.

Connect with MRINetwork