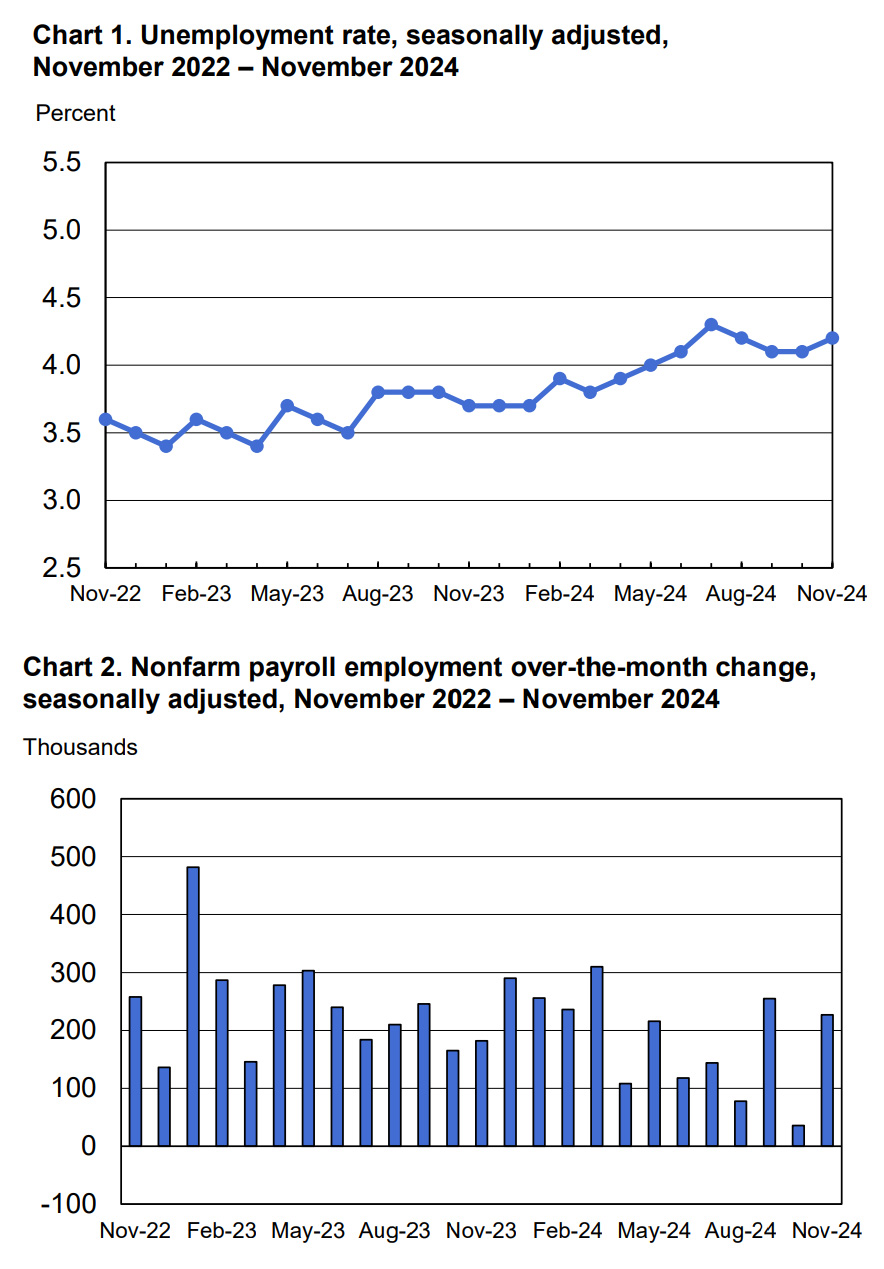

From a paltry adjusted gain of 36,000 jobs in October, the economy shifted gears and reported a non-farm payroll increase of 227,000 for November in today’s Bureau of Labor Statistics (BLS) Employment Situation Summary. This growth is in-line with analysts’ expectations and slightly higher than the average gain of 186,000 per month over the prior 12 months.

From a paltry adjusted gain of 36,000 jobs in October, the economy shifted gears and reported a non-farm payroll increase of 227,000 for November in today’s Bureau of Labor Statistics (BLS) Employment Situation Summary. This growth is in-line with analysts’ expectations and slightly higher than the average gain of 186,000 per month over the prior 12 months.

Both the unemployment rate, at 4.2 percent, and the number of unemployed people, at 7.1 million, changed little in November. These measures are higher than a year earlier, when the jobless rate was 3.7 percent, and the number of unemployed people was 6.3 million.

“With U.S. elections in the rear-view mirror, another national and even global topic still remains undecided. It is a topic that our team of over 1000 talent consultants deal with every day. On one hand, we coach hard-to-find transformative executive, professional, managerial and technical talent who tend to highly value elective work-from-home policies as integral to their career and personal development. On the other side, we develop talent acquisition strategies with growing companies whose leaders tend to agree with British telecommunications industry leader BT Chief Executive Allison Kirkby,” noted Rick Hermanns, president and chief executive officer of HireQuest Inc., parent company of MRINetwork.

“BT’s Kirkby in a bulletin to about 50,000 office-based staff in the UK, as reported in the Financial Times, stated, ‘Current low attendance levels are not going to help us to transform BT Group, or nurture a more integrated, collaborative culture. This is essential for the future of our business, the development of our people, and the service of our customers.’

While it is too early to make a definitive call, many experts are suggesting current JOLTS data, noting an increase in seasonally adjusted job openings to 7.7 million, and today’s BLS data point to a solid jobs base moving into 2025. That foundation along with expected new administration pro-growth tax, trade and regulatory changes could add up to significant demand for skilled workers later in the new year. This dynamic likely will challenge many CEO’s passion for in-office mandates.

As recommend in our recent whitepaper, we counsel both clients and candidates to avoid one-size fits all solutions. Winning firms will develop a metrics-based evaluation process that can deliver peak productivity while enhancing a collaborative culture in what promises to be a dynamic and growing employment marketplace.”

The Wall Street Journal’s Justin Lahart summarized today’s data, “The November jobs figure provides something of a relief, confirming that October’s softening was the result of storm and strike-related distortions, rather than a more fundamental weakening. The general picture is that the labor market has slowed, but is still doing well. Despite the bounceback in jobs, Federal Reserve policymakers still appear likely to cut interest rates again when they meet later this month. That said, Friday’s report does make it easier for them to leave rates on hold if the Labor Department’s November inflation report, due out next Wednesday, comes in warmer than they would like. Economists expect the trend of slowing, but still decent, job growth to carry into next year.”

BNY economist Vincent Reinhart, a former Fed official who served 24 years at the central bank, noted the value of a labor market in equilibrium indicated in today’s data, “If the labor market can remain steady, then it shouldn’t put additional pressure on inflation. So, the strategy is, try to get demand at trend, because if growth and demand are at trend, then you should preserve the current state of the labor market, and the labor market is roughly in balance.”

Key industries reported the following trends in November:

Healthcare added 54,000 jobs in November, in line with the average monthly gain of 59,000 over the prior 12 months.

Employment in leisure and hospitality trended up in November (+53,000), following little change in the prior month (+2,000). Over the month, employment trended up in food services and drinking places (+29,000). Leisure and hospitality had added an average of 21,000 jobs per month over the prior 12 months.

In November, government employment continued to trend up (+33,000), in line with the average monthly gain over the prior 12 months (+41,000).

Employment increased by 32,000 in transportation equipment manufacturing in November, reflecting the return of Boeing workers who were on strike.

Retail trade lost 28,000 jobs in November, after showing little net employment change over the prior 12 months. This may reflect a later Thanksgiving than usual this year as some stores may have held off hiring.

Continuing a recent pattern where job gains have focused on government; healthcare; and leisure and hospitality, employment showed little or no change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; wholesale trade; transportation and warehousing; information; financial activities; professional and business services; and other services.

“Most organizations will solve what I call the ‘tricky trilemma’ as they search for the right balance of three possible decisions – unlimited work-from home, a hybrid approach, or an in-office mandate.

The right answer will vary by industry and even by industry segment. Whatever decision emerges the best managed firms will constantly reevaluate policies as new technologies, new data and new insights are gained allowing management to dynamically shape the world of work,” noted Hermanns.

Connect with MRINetwork