Today’s Bureau of Labor Statistics Employment Situation Summary (BLS) adds some clarity to a good news/bad news marketplace. The bad news including continued Mideast and eastern Europe turmoil, widespread U.S. hurricane damage, seemingly outweighs the good news of a suspended dockworkers strike and the Fed’s rate cut. Within that environment the employment data suggests that the economy continues to create more jobs surpassing most analysts’ expectations.

Today’s Bureau of Labor Statistics Employment Situation Summary (BLS) adds some clarity to a good news/bad news marketplace. The bad news including continued Mideast and eastern Europe turmoil, widespread U.S. hurricane damage, seemingly outweighs the good news of a suspended dockworkers strike and the Fed’s rate cut. Within that environment the employment data suggests that the economy continues to create more jobs surpassing most analysts’ expectations.

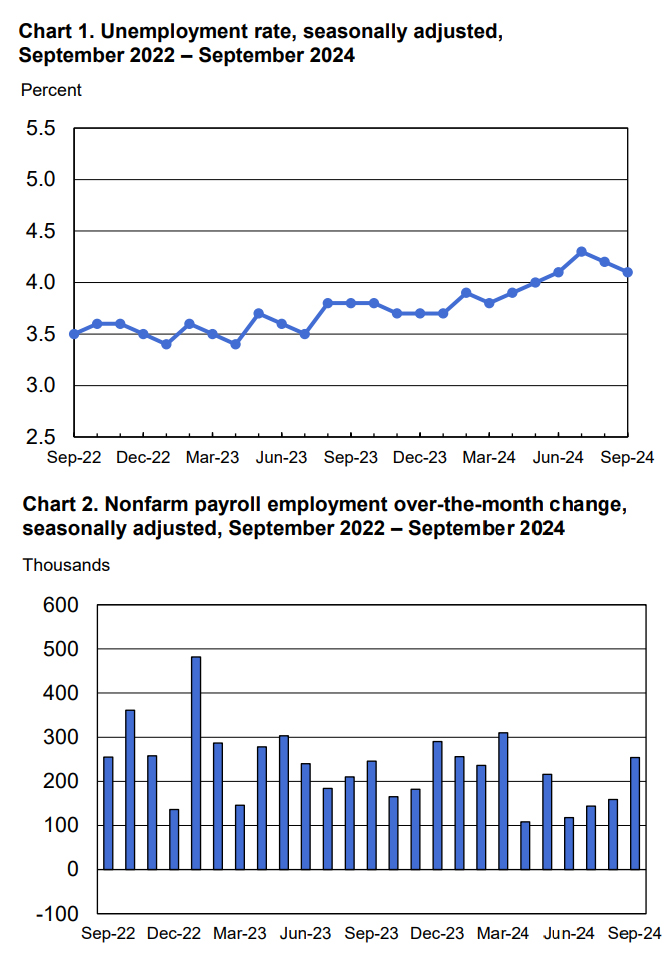

The BLS reported a gain of 254,000 jobs in September, higher than the average monthly gain of 203,000 over the past 12 months. Analysts’ estimates had forecasted gains of about 150,000. It is worth noting that almost 70% of the new jobs were reported from a spike in food service jobs and gains in healthcare, government and social assistance.

Both the unemployment rate, at 4.1 percent, and the number of unemployed people, at 6.8 million, changed little in September. These measures are higher than a year earlier, when the jobless rate was 3.8 percent, and the number of unemployed people was 6.3 million.

Adding to recent job gains, it should be noted that the change in total nonfarm payroll employment for July was revised up by 55,000, from +89,000 to +144,000, and the change for August was revised up by 17,000, from +142,000 to +159,000. With these revisions, employment in July and August combined is 72,000 higher than previously reported.

“While business leaders continue to assess both the impact of the Federal Reserve’s decision to lower interest rates and the possible outcomes of the upcoming U.S. elections, one thing is becoming clearer. The expectations of a hard landing are moving into the rearview mirror and firms, including many of our clients, are focusing on investments in growth.

Snapshots of the labor market like today’s BLS Employment Situation Summary provide a look back at hiring history. Our MRINetwork of over 1,000 talent consultants get daily insight into future hiring expectations among executive, professional, managerial and technical talent and that insight shows demand for top performers remains robust,” noted Rick Hermanns, president and chief executive officer of HireQuest Inc., parent company of MRINetwork.

“What isn’t yet clear is the outcome of a critical challenge facing virtually all firms, particularly in the white-collar arena, the resolution of remote versus in-office work arrangements. Our recent whitepaper analyzes the journey from the pandemic peak of 55 percent of the U.S. workforce working from home to the uneasy truce today where over 60 percent of 1,300 CEOs surveyed by KPMG believe all workers will be in office 2026. As executive recruiters, we find ourselves in the middle of the debate balancing managements’ strong sense that productivity growth is best served in an organized office arrangement while most employees highly value the advantages of work-from-home environment. Our whitepaper points to the inevitability of a hybrid solution custom-fitted for the needs of specific industries and business segments. We remain agnostic as this debate plays out, but on an individual basis, we counsel top candidates to focus on opportunities for career advancement regardless of short-term work from home policies.”

Providing pre-release context to today’s report, David Kelly, chief global strategist at JPMorgan Asset Management noted, “While we’re looking at 150,000 jobs added, I would not be surprised if it comes in at 50,000 and I would not be surprised if it comes in at 250,000. I don’t think people should get too freaked out either way about this number.” Referencing the Feds possible reaction he continued, “A strong number wouldn’t really change their position. A weak number could tempt them to another 50 basis points.” However, Kelly said the Fed is more likely to look at the employment picture as a “mosaic” rather than just an individual data point.

Adding further context RSM US chief economist Joe Brusuelas remarked, “The American labor market remains solid. This has got to do with fundamental underlying demand out in the economy as job growth continues and wages are increasing.”

Key industries reported the following trends in September:

Employment in food services and drinking places rose by 69,000 in September, well above the average monthly gain of 14,000 reported over the prior 12 months.

Healthcare added 45,000 jobs in September, slightly below the average monthly gain of 57,000 over the prior 12 months.

Employment in government continued its upward trend in September (+31,000). Government had an average monthly gain of 45,000 jobs over the prior 12 months. Over the month, employment continued to trend up in local government (+16,000) and state government (+13,000). Also, employment in social assistance increased by 27,000 in September.

Construction employment continued to trend up in September (+25,000), similar to the average monthly gain over the prior 12 months (+19,000). Over the month, nonresidential specialty trade contractors added 17,000 jobs.

Employment showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; manufacturing; wholesale trade; retail trade; transportation and warehousing; information; financial activities; professional and business services; and other services.

“The Wall Street Journal recently headlined, ‘The Work From Home Free-for-All Is Coming to an End’ in their profile of Amazon’s surprise memo calling corporate staffers back to office full time. In spite of the certainty of the headline and after a full-page analysis by the three reporters, the article ended with a pragmatic quote on corporate work arrangements from Intuit’s CEO Sason Goodarzi, ‘There’s a massive experiment going on, I think it’s important that we remain curious as to what’s the optimal answer.’ Stay tuned as a hybrid solution emerges from this vibrant experiment,” noted Hermanns.

Connect with MRINetwork