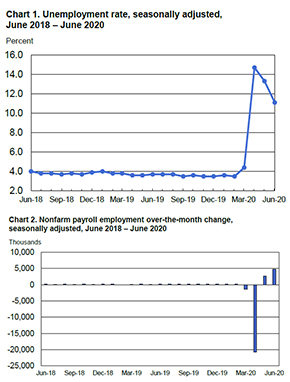

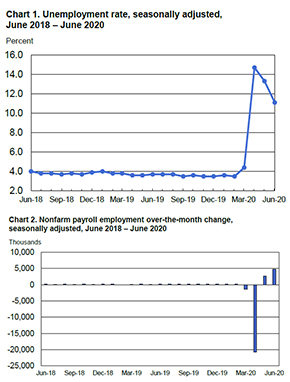

Following strong May results, the hiring recovery continued to gain momentum with much better than expected job gains in June. The U.S. jobless rate fell 2.2 percentage points to 11.1 percent and payrolls rose by 4.9 million as businesses continued to look to a future free of pandemic-induced supply chain disruptions and its drag on overall demand.

Following strong May results, the hiring recovery continued to gain momentum with much better than expected job gains in June. The U.S. jobless rate fell 2.2 percentage points to 11.1 percent and payrolls rose by 4.9 million as businesses continued to look to a future free of pandemic-induced supply chain disruptions and its drag on overall demand.

“Today’s employment data adds support to a business trend our Network of almost 400 executive recruitment offices have reported. We continue to see month-over-month improvements in client demand for professional, technical, executive and managerial talent,” said Bert Miller, president and CEO of MRINetwork. “In spite of travel barriers and limitations on face-to-face interviewing, companies are recognizing the need to strengthen their organizations by hiring talented people who can thrive in the new world of work which is emerging from the coronavirus-impacted economy.”

Forecasts for the June jobs report had been wide ranging with a consensus 2.9 million new jobs. Analysts remained more uncertain than normal after the surprising gain of 2.5 million jobs versus a consensus of a decline of 7.5 million jobs in May. “We’ve got big forces at work here,” said James Sweeney, chief economist at Credit Suisse Group AG in comments to Bloomberg. “In addition to the return of workers and the (May) misclassification, more recently you have the new wave of infections slowing the return. So, this is tricky.” The June jobs report is also expected to influence congressional debate over the dimensions of an anticipated federal coronavirus relief bill.

The BLS reported broad improvements in the labor market reflecting the continued resumption of economic activity that had been curtailed in March and April due to the coronavirus pandemic and efforts to contain it. In June, employment in leisure and hospitality rose sharply. Notable job gains also occurred in retail trade, education and health services, other services, manufacturing, and professional and business services.

Total nonfarm payroll employment increased by 4.9 million in June, following an increase of 2.7 million in May. These gains reflect a partial resumption of economic activity that had been curtailed due to the coronavirus pandemic in April and March, when employment fell by a total of 22.2 million in the two months combined. In June, nonfarm employment was 14.7 million, or 9.6 percent, lower than its February level.

Commenting on the June results to Fox Business, Andrew Chamberlain, chief economist at Glassdoor noted the better-than-expected report provided a “powerful signal of how swiftly U.S. job growth can bounce back and how rapidly businesses can reopen once the nation finally brings the coronavirus under control – a reason for optimism in coming months.”

Also commenting on the June jobs report and noting the current resurgence of coronavirus cases, economist Thomas Simons of Jeffries added, “There’s continued risk that a second-wave could reverse some of these job gains in July, but that should not take away from the strength of the June data.”

In June, employment in leisure and hospitality increased by 2.1 million, accounting for about two-fifths of the gain in total nonfarm employment. Over the month, employment in food services and drinking places rose by 1.5 million, following a gain of the same magnitude in May. Despite these gains, employment in food services and drinking places remains down by 3.1 million since February. Employment also rose in June in amusements, gambling, and recreation (+353,000) and in the accommodation industry (+239,000).

Employment in retail trade rose by 740,000, after a gain of 372,000 in May. On net, employment in the industry remains 1.3 million lower than in February. In June, notable job gains occurred in clothing and clothing accessories stores (+202,000), general merchandise stores (+108,000), furniture and home furnishings stores (+84,000), and motor vehicle and parts dealers (+84,000).

Professional and business services added 306,000 jobs in June, 1.8 million below its February level. In June, employment rose in temporary help services (+149,000), services to buildings and dwellings (+53,000), and accounting and bookkeeping services (+18,000). By contrast, employment declined in computer systems design and related services (-20,000).

Construction employment increased by 158,000 in June, following a gain of 453,000 in May. These gains accounted for more than half of the decline in March and April (-1.1 million combined). Month-over-month gains occurred in specialty trade contractors (+135,000), with growth equally split between the residential and nonresidential components. Job gains also occurred in construction of buildings (+32,000).

Financial activities added 32,000 jobs in June, with over half of the gain in real estate (+18,000).

Connect with MRINetwork