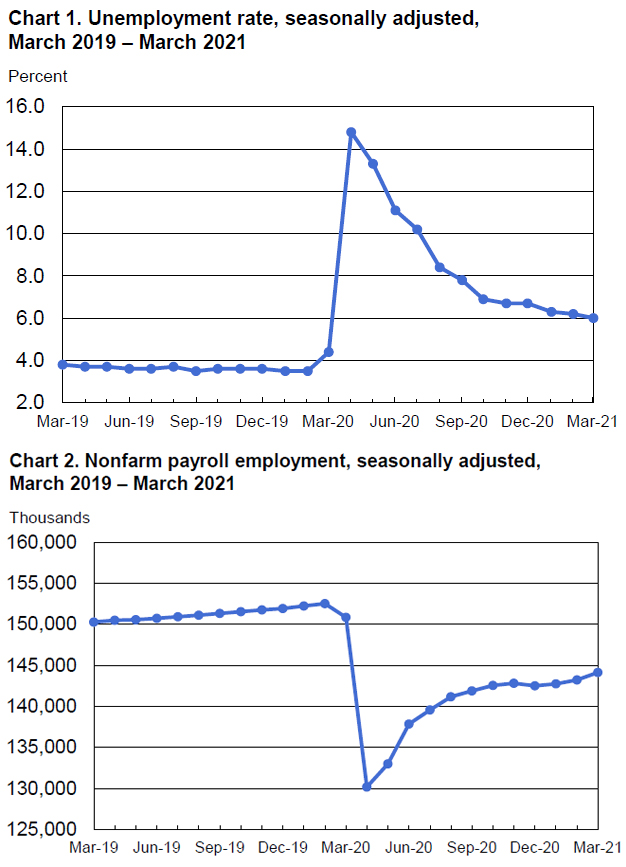

The U.S. Bureau of Labor Statistics (BLS) today reported total nonfarm payroll employment increased by 916,000 in March, significantly above consensus estimates. Unemployment rate fell to 6.0 percent, down considerably from its April 2020 high of 14.7 percent.

The U.S. Bureau of Labor Statistics (BLS) today reported total nonfarm payroll employment increased by 916,000 in March, significantly above consensus estimates. Unemployment rate fell to 6.0 percent, down considerably from its April 2020 high of 14.7 percent.

Job growth was widespread, led by gains in leisure and hospitality, education and construction.

“The robust recovery of the U.S. labor market continues as reflected in today’s BLS Employment Situation Report. Our Network of over 300 executive recruitment firms is seeing robust growth driven by our clients’ need for transformative talent in this rapidly improving environment,” said Bert Miller, President and CEO of MRI. “Our recruiting professionals reported double digit year-over-year growth in February, with particular strength in the financial, technology and professional services sectors.”

The BLS reported 21.0 percent of all non-farm employed persons teleworked because of the coronavirus pandemic, down from 22.7 percent in February. These data refer to employed persons who teleworked or worked at home for pay at some point in the last four weeks specifically because of the pandemic.

Analysts are anticipating continued job growth acceleration in coming months as the confluence of vaccinations, stimulus spending and pent-up consumer demand power the economy.

“There’s a seismic shift going on in the U.S. economy,” said Beth Ann Bovino, a Ph.D. economist at S&P Global. “The confluence of additional federal stimulus, growing consumer confidence and the feeling that the pandemic is close to abating—despite rising infections in recent weeks—is propelling economic growth and hiring.”

“We were expecting a big number, and today’s jobs report delivered in a major way. It is the flip side of what we saw for March of last year and another clear sign that the U.S. economy is on a strong path to recovery,” said Eric Merlis, head of global markets trading at Citizens Bank.

In March, employment in leisure and hospitality increased by 280,000, as pandemic-related restrictions steadily eased in many parts of the country. Nearly two-thirds of the increase was in food services and drinking places (+176,000). Job gains also occurred in arts, entertainment, and recreation (+64,000) and in accommodation (+40,000).

In March, employment increased in both public and private education, reflecting the continued resumption of in-person learning and other school-related activities. Total jobs increased by 190,000.

Construction added 110,000 jobs in March, following job weather-related losses in the previous month. Employment growth in the industry was widespread in March, with gains of 65,000 in specialty trade contractors, 27,000 in heavy and civil engineering construction, and 18,000 in construction of buildings.

Employment in professional and business services rose by 66,000 over the month. In March, employment in administrative and support services continued to trend up (+37,000). Employment also continued an upward trend in management and technical consulting services (+8,000) and in computer systems design and related services (+6,000).

Manufacturing industry and the transportation and warehousing sectors saw employment growth of 101,000 in March. Of note, since the pre-pandemic month of February 2020, employment in couriers and messengers is up by 206,000 (or 23.3 percent) as consumers opted for at-home delivery of an expanding list of items.

Employment in wholesale trade increased by 24,000 in March, while retail trade added 23,000 jobs.

Financial activities added 16,000 jobs in March. Job gains in insurance carriers and related activities (+11,000) and real estate (+10,000) more than offset losses in credit intermediation and related activities.

Employment in healthcare and information changed little in March.

“The competition for talent is placing demands on clients to ensure their firm is a ‘destination’ for executive, technical, professional and managerial performers who are true multipliers.

“A strong employer brand is critical as job growth momentum accelerates in 2021. We counsel our clients to focus on the substantive elements of core brand strength. It is essential to communicate the firm’s values, goals, and culture, while not getting caught up in a flavor-of-the-month competition on issues like work from home policies.

“In time, the value of face-to-face collaboration will be recognized as a key component of team success. We urge clients to develop comprehensive flexible workforce solutions incorporating best practices from the virtual environment, learned during the pandemic, into a hybrid setup. Clients now have total talent access solutions available to them as they look to regrow their workforce, including both remote-work models and contract staffing solutions that fit into the new world of work,” noted Miller.

The U.S. Bureau of Labor Statistics (BLS) today reported total nonfarm payroll employment increased by 916,000 in March, significantly above consensus estimates. Unemployment rate fell to 6.0 percent, down considerably from its April 2020 high of 14.7 percent.

The U.S. Bureau of Labor Statistics (BLS) today reported total nonfarm payroll employment increased by 916,000 in March, significantly above consensus estimates. Unemployment rate fell to 6.0 percent, down considerably from its April 2020 high of 14.7 percent.

Connect with MRINetwork