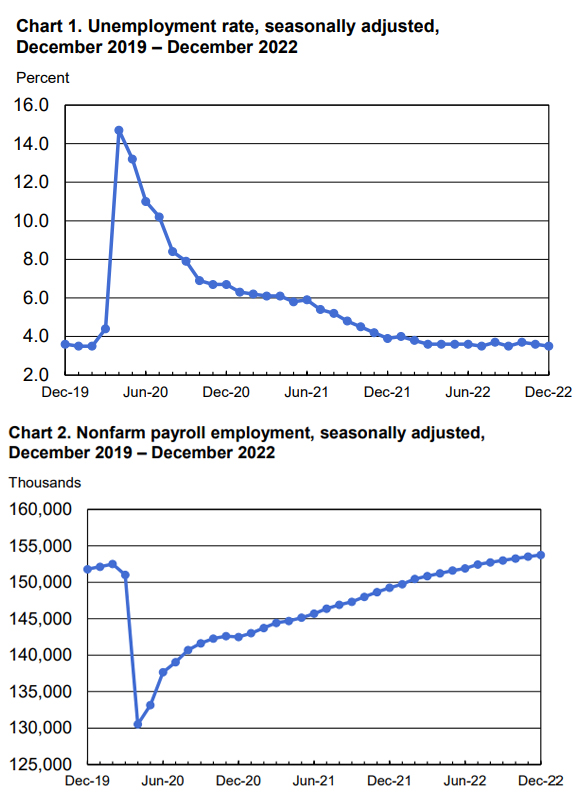

The U.S. Bureau of Labor Statistics (BLS) December jobs report once again indicated a solid hiring environment in spite of Federal Reserve Bank efforts to slow the economy and tighten the job market. Today the BLS reported a gain of 223,000 non-farm jobs while unemployment edged down to 3.5 percent. Notably, the unemployment rate has remained in a narrow range of 3.5 to 3.7 percent since March 2022.

The U.S. Bureau of Labor Statistics (BLS) December jobs report once again indicated a solid hiring environment in spite of Federal Reserve Bank efforts to slow the economy and tighten the job market. Today the BLS reported a gain of 223,000 non-farm jobs while unemployment edged down to 3.5 percent. Notably, the unemployment rate has remained in a narrow range of 3.5 to 3.7 percent since March 2022.

Viewed across the overall U.S. labor market supply for talent remained historically tight, with many employers competing for a limited pool of workers and bidding up wages. That labor pressure is particularly evident among the civilian workforce with a bachelor’s degree and higher — the primary target of MRINetwork’s recruitment efforts. Unemployment in that cohort at 1.9 percent, suggests virtual full employment.

“Hiring has been pretty resilient in the face of persistent Fed rate hikes and a desire by the Fed to slow down the labor market,” said Michael Gapen, head of U.S. economics at Bank of America. “There’s a lot of jobs out there that remain to be filled and it seems like it’s translating into strong hiring.”

“All indications are that the labor market remains strong,” said Sung Won Sohn, a finance and economics professor at Loyola Marymount University in Los Angeles. “Leisure and hospitality employers are not able to get anybody even after wages have been going up. That pattern has and will continue for a while, so that’s where the rubber hits the road.”

Providing an overview of today’s numbers, Fox Business reporter Megan Henny noted, “The report will likely do little to sway the Federal Reserve in its fight against inflation, which has already seen policymakers raise interest rates at the most aggressive pace since the 1980s in a bid to crush out-of-control consumer prices and cool the labor market.”

The total nonfarm payroll employment increased by 223,000 in December, roughly in line with analysts’ expectations.

In December, employment in leisure and hospitality rose by 67,000. Employment continued to trend up in food services and drinking places (+26,000); amusements, gambling, and recreation (+25,000); and accommodation (+10,000). Employment in the industry remains below its pre-pandemic February 2020 level by 932,000, or 5.5 percent.

Healthcare employment increased by 55,000 in December, with gains primarily in ambulatory healthcare services (+30,000), hospitals (+16,000).

Employment in construction increased by 28,000 in December, as specialty trade contractors added 17,000 jobs. Construction employment increased by an average of 19,000 per month in 2022, little different than the average of 16,000 per month in 2021.

Employment in the “other services” industry continued to trend up in December (+14,000). Monthly job growth in this sector averaged 14,000 in 2022, lower than the average of 24,000 per month in 2021.

In December, employment across a number of industries remained little changed versus the prior month.

Employment in retail trade rose 9,000 in December and mining employment increased by 4,000. Over the month, employment in manufacturing changed little (+8,000), as job gains in durable goods (+24,000) were partially offset by losses in nondurable goods (-16,000).

In December, employment in transportation and warehousing changed little (+5,000). That same pattern was reflected in employment in professional and business services which remained little changed in December (-6,000).

Over the month, employment was flat versus the prior month in other major industries, including wholesale trade, information, and financial activities.

Client demand for talent among the over 250 executive recruitment offices in the MRINetwork reflects this tight labor market. For example, through eleven months in 2022 executive placements in Professional Services, Manufacturing and Distribution, and Construction were significantly higher versus the same period in 2021.

Looking forward, MRINetwork executive recruiters anticipate continued demand for highly-skilled technical, executive, professional and managerial talent despite economic headwinds. Astute clients understand the need to seek and hire transformational talent throughout the business cycle. They seek top performers with not only experience and skillsets but who have ambition, initiative, a bias towards effective action, and an ability to thrive in the client’s corporate culture.

The U.S. Bureau of Labor Statistics (BLS) December jobs report once again indicated a solid hiring environment in spite of Federal Reserve Bank efforts to slow the economy and tighten the job market. Today the BLS reported a gain of 223,000 non-farm jobs while unemployment edged down to 3.5 percent. Notably, the unemployment rate has remained in a narrow range of 3.5 to 3.7 percent since March 2022.

The U.S. Bureau of Labor Statistics (BLS) December jobs report once again indicated a solid hiring environment in spite of Federal Reserve Bank efforts to slow the economy and tighten the job market. Today the BLS reported a gain of 223,000 non-farm jobs while unemployment edged down to 3.5 percent. Notably, the unemployment rate has remained in a narrow range of 3.5 to 3.7 percent since March 2022.