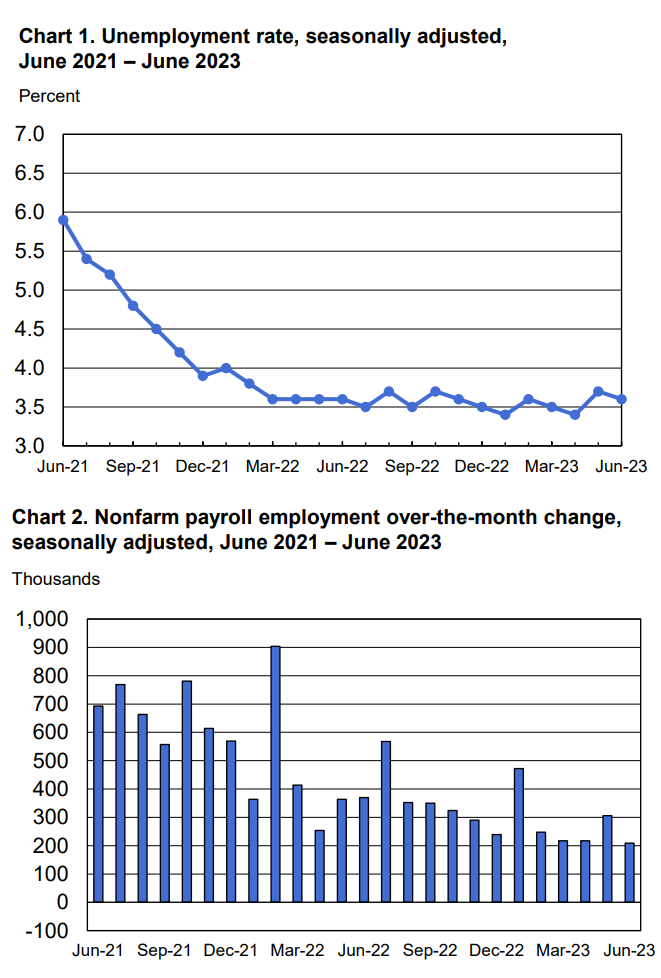

While economists, the Federal Reserve and business leaders continue to try to gauge the trajectory of the economy, the U.S. employment market just keeps growing although at a slightly slower pace. Today’s June U.S. Bureau of Labor Statistics (BLS) report indicates non-farm payroll increased by 209,000 and averaged 278,000 for the first-half of 2023. For the same 6-month period in 2022 job growth averaged 399,000 per month.

While economists, the Federal Reserve and business leaders continue to try to gauge the trajectory of the economy, the U.S. employment market just keeps growing although at a slightly slower pace. Today’s June U.S. Bureau of Labor Statistics (BLS) report indicates non-farm payroll increased by 209,000 and averaged 278,000 for the first-half of 2023. For the same 6-month period in 2022 job growth averaged 399,000 per month.

The change in total nonfarm payroll employment for April was revised down by 77,000, to +217,000, and the change for May was revised down by 33,000, to +306,000. With these revisions, employment in April and May combined is 110,000 lower than previously reported.

Both the unemployment rate, at 3.5 percent, and the number of unemployed persons, at 6.0 million, changed little in June. Unemployment among the college educated labor force remained at what is essentially full-employment at 2.0 percent.

“When leaders of our Network of over 200 executive recruitment offices get together in regional, national and even international conferences, we discuss a wide range of talent industry topics that drive client business performance. It’s not unusual for one or more of our presenters to provide a quote from that noted authority on organizational transformation, Ted Lasso,” said Nancy Halverson, senior vice president field operations MRINetwork. “This month’s BLS data remined me of one of my favorite Lasso quotes, ‘Taking on a challenge is a lot like riding a horse. If you’re comfortable doing it, you’re probably doing it wrong.’ Today’s employment numbers point to a continuation of a pattern of steady but slowing job growth in the face of expectations of an inflation-driven economic slowdown. If you are comfortable with your firm’s current goals or your individual career goals in today’s seemingly static business environment, you might want to consider challenging the status quo.

Our best clients continuously seek out top talent. They create hiring process flexibility and move quickly to add a transformational player even if they have no specific current opening. And the best managers, executives, professional and technical talent that we represent have a track record of fearlessly taking on new challenges and new responsibilities as they grow their career. Both behaviors come with risk and can be uncomfortable in the short term, but they are the behaviors that drive positive personal and business performance.”

Providing an overview of the drivers of today’s data the Wall Street Journal’s Sarah Chaney Cambon noted, “Several factors contribute to persistent hiring. Employers in leisure and hospitality and local government are still staffing up to prepandemic levels three years after they laid off droves of workers. Hospitals and nursing homes need more workers to serve the fast-growing elderly population. Residential-home builders are clinging to labor despite higher interest rates because of a chronic shortage of available housing. And industrial and infrastructure businesses continue to snap up workers for projects related to electric-vehicle batteries and semiconductors.”

Providing additional context to the BLS report, CNBC’s Jeff Cox noted, “Job growth would have been even lighter without a boost in government jobs, which increased by 60,000, almost all of which came from the state and local levels. Employment growth eased in June, taking some steam out of what had been a stunningly strong labor market. The total, (+209,000) while still solid from a historical perspective, marked a considerable drop from May’s downwardly revised total of 306,000 and was the slowest month for job creation since payrolls fell by 268,000 in December 2020.”

Employment continued to trend up in many of the industries that have fueled growth in recent months.

Healthcare added 41,000 jobs in June. Job growth occurred in hospitals (+15,000), nursing and residential care facilities (+12,000), and home healthcare services (+9,000).

Employment in construction continued to trend up in June (+23,000). Employment in the industry has increased by an average of 15,000 per month thus far this year, compared with an average of 22,000 per month in 2022.

Professional and business services employment up ticked slightly in June (+21,000). Monthly job growth in the industry has averaged 40,000 in 2023, down from 62,000 per month in 2022. Employment in professional, scientific, and technical services continued to trend up over the month (+23,000).

In June, employment in leisure and hospitality was little changed (+21,000). This marks the third consecutive month of little employment change for this industry. Employment in the industry remains below its February 2020 level by 369,000, or 2.2 percent.

Retail trade employment changed little in June (-11,000). The decline was seen primarily in building material and garden equipment and supplies dealers (-10,000).

Employment in transportation and warehousing changed little in June (-7,000) and has shown no clear trend in recent months.

Employment showed little or no change over the month in other major industries, including mining, quarrying, and oil and gas extraction; manufacturing; wholesale trade; information; financial activities; and other services.

“Now, Ted Lasso might not be real,” noted Halverson, ”and he is certainly not an expert on the finer points of soccer. But there is much more that Ted Lasso can teach us about business, careers and life in general. As Ted opined, ‘As the man once said, the harder you work, the luckier you get.’ “

While economists, the Federal Reserve and business leaders continue to try to gauge the trajectory of the economy, the U.S. employment market just keeps growing although at a slightly slower pace. Today’s June U.S. Bureau of Labor Statistics (BLS) report indicates non-farm payroll increased by 209,000 and averaged 278,000 for the first-half of 2023. For the same 6-month period in 2022 job growth averaged 399,000 per month.

While economists, the Federal Reserve and business leaders continue to try to gauge the trajectory of the economy, the U.S. employment market just keeps growing although at a slightly slower pace. Today’s June U.S. Bureau of Labor Statistics (BLS) report indicates non-farm payroll increased by 209,000 and averaged 278,000 for the first-half of 2023. For the same 6-month period in 2022 job growth averaged 399,000 per month.