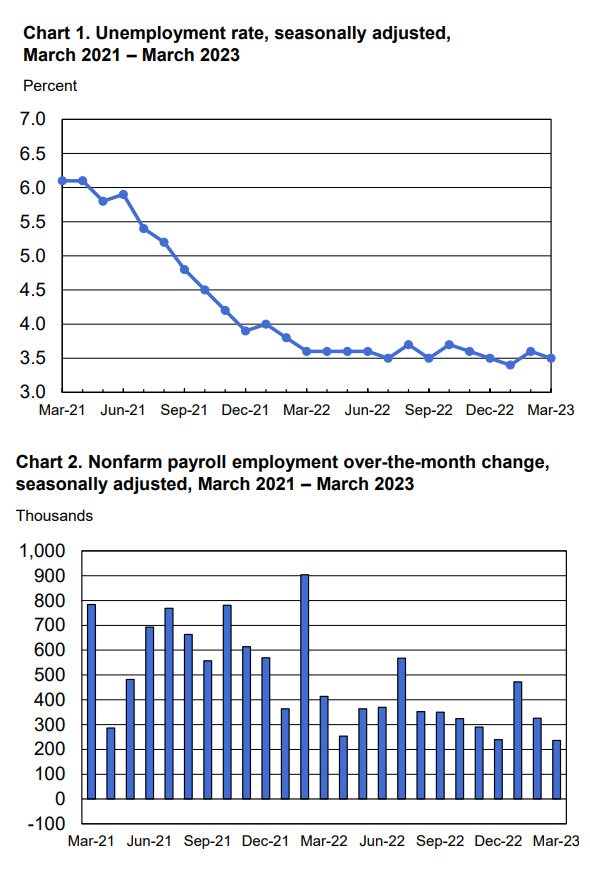

U.S. employment market growth continues, at a slightly lower pace, a full year after the Federal Reserve began its efforts to reduce inflation by applying brakes to the economy. Today’s U.S. Bureau of Labor Statistics (BLS) March report indicated non-farm payroll increased by 236,000, compared to an average monthly gain of 334,000 over the past 6 months.

U.S. employment market growth continues, at a slightly lower pace, a full year after the Federal Reserve began its efforts to reduce inflation by applying brakes to the economy. Today’s U.S. Bureau of Labor Statistics (BLS) March report indicated non-farm payroll increased by 236,000, compared to an average monthly gain of 334,000 over the past 6 months.

Both the unemployment rate, at 3.5 percent, and the number of unemployed persons, at 5.8 million, changed little in March. These measures have shown little net movement since early 2022. Unemployment among the college educated labor force remained at what is essentially full-employment at 2.0 percent.

“Data from this month’s BLS report continue to show a stubborn resilience in the employment marketplace. Our internal metrics also reflect this steady hiring strength. The demand for executive, professional, technical and managerial talent continues in the broad range of industries served by our over 200 executive recruitment offices,” noted Nancy Halverson vice president, MRINetwork. “Within that positive trend, our talent consultants are seeing growing tension between many employers like Walt Disney Co. and Starbucks Corp. who are asking office staff to report in person more often versus a solid segment of talented workers who prefer a more liberal work from home option. Our recruitment teams generally play the role of an honest broker as we coach our client companies to focus on a top candidate’s cultural fit, growth potential, track record of success and work ethic versus an arbitrary insistence on 100% in-office requirement.”

Initial reporting by the Wall Street Journal’s Sarah Chaney Cambon characterized today’s data as “gradually cooling.” She quoted Robert Frick, corporate economist at Navy Federal Credit Union, “The great labor market machine is finally slowing down some, but it’s still got a lot of strength left.”

Fox Business reporter, Ken Martin noted, “While the overall pace of job growth is slowing, the labor market is still very tight with many employers hesitant to lay off workers.” He reached out to Brad McMillan, Chief Investment Officer for Commonwealth Financial Network, who observed, “For the economy, more jobs are good: more workers, more wage income, more spending ability, and so forth. There’s no real downside. For financial markets, however, a strong report would be problematic. Those workers—earning and spending their wages—add to demand, which adds to inflation. So, a strong report would be bad news for the Fed, for interest rates, and for markets.”

Employment continued to trend up in many of the industries that have fueled growth in recent months.

Leisure and hospitality added 72,000 jobs in March, however at a rate lower than the average monthly gain of 95,000 over the prior 6 months. Most of the job growth occurred in food services and drinking places, where employment rose by 50,000 in March.

Employment in professional and business services continued to trend up in March (+39,000), in line with the average monthly growth over the prior 6 months (+34,000).

Over the month, healthcare added 34,000 jobs, lower than the average monthly gain of 54,000 over the prior 6 months. In March, job growth occurred in home healthcare services (+15,000) and hospitals (+11,000).

In March, employment in transportation and warehousing changed little (+10,000). Couriers and messengers (+7,000) and air transportation (+6,000) added jobs, while warehousing and storage lost jobs (-12,000). Employment in transportation and warehousing has shown little net change in recent months.

Employment in retail trade changed little in March (-15,000). Job losses in building material and garden equipment and supplies dealers (-9,000) and in furniture, home furnishings, electronics, and appliance retailers (-9,000) were partially offset by a job gain in department stores (+15,000).

Jobs showed little change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; information; financial activities; and other services.

Adding to her comments on the work from home trend Halverson noted, “I have personally seen top senior management talent and their multi-office organizations thrive with leaders who are in 75 percent to 100 percent hybrid roles as long as they regularly and effectively travel to team centers at least six or seven times a year. Is that the right mix for every business? Certainly not. But we urge those making hiring decisions to recognize different paths to improving productivity, team building, mentoring, training and talent attraction.”

U.S. employment market growth continues, at a slightly lower pace, a full year after the Federal Reserve began its efforts to reduce inflation by applying brakes to the economy. Today’s U.S. Bureau of Labor Statistics (BLS) March report indicated non-farm payroll increased by 236,000, compared to an average monthly gain of 334,000 over the past 6 months.

U.S. employment market growth continues, at a slightly lower pace, a full year after the Federal Reserve began its efforts to reduce inflation by applying brakes to the economy. Today’s U.S. Bureau of Labor Statistics (BLS) March report indicated non-farm payroll increased by 236,000, compared to an average monthly gain of 334,000 over the past 6 months.