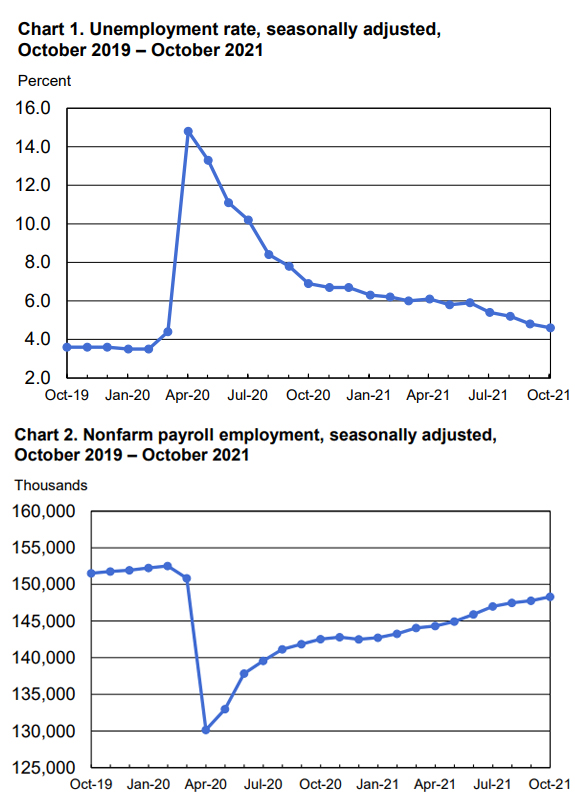

There are tangible signs that the economy is emerging from a delta virus-induced slowdown reflected in improved consumer confidence scores, increased October new homes sales, continued declines in initial unemployment claims and in today’s U.S. Bureau of Labor Statistics (BLS) survey. Employment growth in October of 531,000 indicated a solid gain, above analysts’ expectations but still below the higher pace from earlier this year. Job growth was recorded throughout the report with particular gains in leisure and hospitality, professional and business services, manufacturing and transportation, and warehousing.

There are tangible signs that the economy is emerging from a delta virus-induced slowdown reflected in improved consumer confidence scores, increased October new homes sales, continued declines in initial unemployment claims and in today’s U.S. Bureau of Labor Statistics (BLS) survey. Employment growth in October of 531,000 indicated a solid gain, above analysts’ expectations but still below the higher pace from earlier this year. Job growth was recorded throughout the report with particular gains in leisure and hospitality, professional and business services, manufacturing and transportation, and warehousing.

The unemployment rate declined by 0.2 percentage point to 4.6 percent.

The percent of nonfarm workers reporting that they teleworked at some point in the past four weeks decreased significantly to 11.6 percent versus 13.2 percent in the prior-month and from the 13 plus percent range for the past several months. This could be a one-month aberration, or it might indicate an acceleration in rate of return to on-site work.

“Our MRINetwork leaders in over 300 search firms pay close attention to the month-to-month trends in the BLS data. This month once again we see continued job creation. But each month I caution our team to ensure that their clients don’t take a short-term reactive hiring approach based on a current supply-demand snapshot. Our most successful clients have a clear understanding of the need to be constantly attracting top talent, to have a 12-to-18-month hiring perspective. Those who hire with a short-term lens, focused on next the quarter’s profitability will find it daunting to attract the best talent,” said Bert Miller, President and CEO of MRI.

“Great companies are looking at their talent needs beyond the range that served them well in earlier economies. These firms not only look beyond a short-term horizon, but they also clearly know why they do what they do, they have a defined culture, and more importantly they have a deep commitment to a set of core values. These firms provide resources to nurture their team’s skills growth as they consistently market to the best talent. Not too surprisingly they see by-product benefit reflected in revenue and profit growth.”

Bank of America U.S. economist Alex Lin reflecting on recent delta impacts noted, “We think a big constraint or headwind causing some of the slowdown we’ve seen in recent months was COVID-related, and now it seems the cases and hospitalizations are trending in the right direction.” He expected restaurants, hotels, and retailers to be among the businesses adding workers in big numbers.

Wall Street Journal reporter Josh Mitchell added insight into this month’s BLS data, “The report suggests the labor market and economy is picking back up after the recovery fell into a summer rut because of the Delta variant. Delta cases declined. Employers desperate to hire to meet strong demand from consumers are rapidly raising wages, dangling bonuses and offering more flexible hours. And households are spending down a big pile of savings that had been boosted by federal stimulus money and extra unemployment benefits. Even with last month’s pickup, job growth remained below the monthly average of 641,000 jobs that the economy created in the first seven months of the year.”

Employment in leisure and hospitality increased by 164,000 in October and has risen by 2.4 million thus far in 2021. Over the month, employment rose by 119,000 in food services and drinking places and by 23,000 in accommodation.

Professional and business services added 100,000 jobs in October, including a gain of 41,000 in temporary help services. Employment continued to rise in management and technical consulting services (+14,000), other professional and technical services (+9,000), scientific research and development services (+6,000).

Employment in manufacturing increased by 60,000 in October, led by a gain in motor vehicles and parts (+28,000). Employment also rose in fabricated metal products (+6,000), chemicals (+6,000), as well as printing and related support activities (+4,000).

Employment in transportation and warehousing increased by 54,000 in October and is 149,000 above its February 2020 level. In October, job gains occurred in warehousing and storage (+20,000), transit and ground passenger transportation (+16,000), air transportation (+9,000), and truck transportation (+8,000). Employment in couriers and messengers decreased by 5,000 in October, after increasing in the prior 3 months.

Solid growth was seen across a broad range of other non-governmental sectors. In October employment in the construction industry increased by 44,000 and job gains were noted in healthcare, retail trade, “other services,” financial, and wholesale trade. Employment in information changed little in October.

“The labor market remains tight in the executive, professional, managerial and technical arena that is our Network’s core focus. In our most recently reported month, September 2021, our same-office billings increased almost 75% versus the prior-year period. On a year-to-date basis every industry practice has grown significantly versus the same period in 2020. Exceptional growth was seen in Healthcare, Financial, and the Professional Services industries. Talent remains tight in both permanent positions and increasingly in work-from-anywhere arrangements or contract placement positions. Firms throughout the economy should anticipate continued pressure in finding, hiring, and on-boarding the best and brightest performers. The shift in the world of work over the next few years will leave firms competing for skilled workers like never before,” said Miller.

There are tangible signs that the economy is emerging from a delta virus-induced slowdown reflected in improved consumer confidence scores, increased October new homes sales, continued declines in initial unemployment claims and in today’s U.S. Bureau of Labor Statistics (BLS) survey. Employment growth in October of 531,000 indicated a solid gain, above analysts’ expectations but still below the higher pace from earlier this year. Job growth was recorded throughout the report with particular gains in leisure and hospitality, professional and business services, manufacturing and transportation, and warehousing.

There are tangible signs that the economy is emerging from a delta virus-induced slowdown reflected in improved consumer confidence scores, increased October new homes sales, continued declines in initial unemployment claims and in today’s U.S. Bureau of Labor Statistics (BLS) survey. Employment growth in October of 531,000 indicated a solid gain, above analysts’ expectations but still below the higher pace from earlier this year. Job growth was recorded throughout the report with particular gains in leisure and hospitality, professional and business services, manufacturing and transportation, and warehousing.