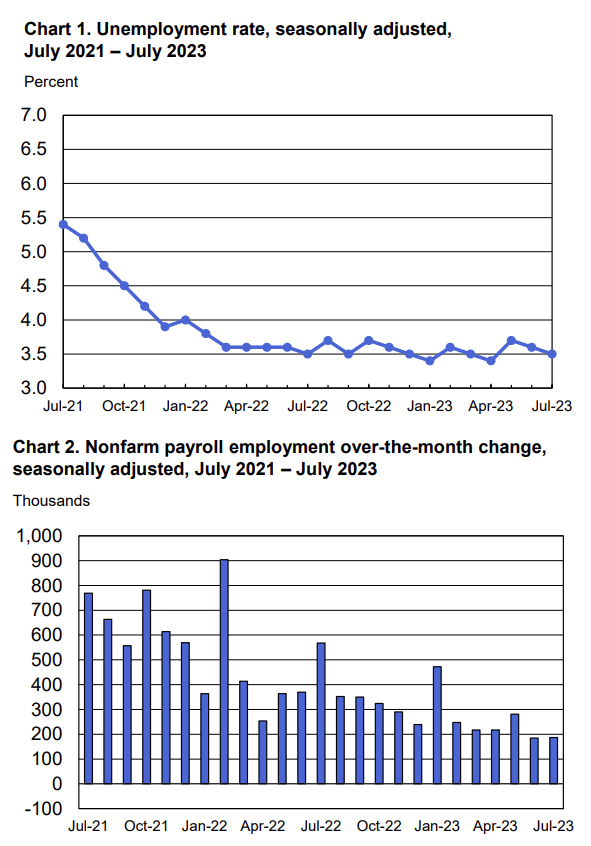

The U.S. labor market remains vibrant as the July U.S. Bureau of Labor Statistics (BLS) reported non-farm payroll increased by 187,000. Both the unemployment rate, at 3.5 percent, and the number of unemployed persons, at 5.8 million remained essentially flat versus the prior month.

The U.S. labor market remains vibrant as the July U.S. Bureau of Labor Statistics (BLS) reported non-farm payroll increased by 187,000. Both the unemployment rate, at 3.5 percent, and the number of unemployed persons, at 5.8 million remained essentially flat versus the prior month.

After a jump in January, hiring has slowed in 2023 to near the slowest pace in the pandemic cycle. Last year, the BLS reported job gains averaging 400,000 per month. Other data from the Labor Department showed a marked slowdown in labor costs in the second quarter due to a solid rebound in worker productivity. These factors led Bill Adams, chief economist at Comerica Bank in Dallas to note, “Recession risk is receding.”

“From my perspective as a veteran talent recruiter and senior operations manager of one of the world’s largest executive search organizations I offer a very simple summary of today’s BLS data. The white-collar employment marketplace continues to outperform expectations. Smart candidates with in-demand skills remain a coveted commodity, and our best client firms have talent acquisition strategies in place to strengthen their organizations as they move quickly and effectively to add to their talent roster. Today’s report reinforces our core belief that the talent environment for both clients and candidates is aligned to favor bold business and career actions,” noted Nancy Halverson, senior vice president, field operations, MRINetwork.

“Virtually every one of our 200+ Network offices in dozens of industry sectors see solid underlying demand for top talent even in the face of the Federal Reserve’s efforts to subdue inflation. They counsel their clients to have a comprehensive talent strategy in place. Key to that strategy is an effective external recruitment process, smart onboarding experiences from first touch to team integration, best-in-class internal mobility programs, and active plans to leverage interim employment.”

CNBC’s Jeff Cox provided context to today’s report with insightful observations on the broader jobs market, “The clues to what the generally backwards-looking (BLS) report tells about the future lie in some under-the-hood numbers: prime-age labor force participation, hours worked and average hourly earnings, and the sectors where job growth was highest. The prime-age participation rate, for one, focuses on the 25-to-54 age group cohort. While the overall rate has been stuck at 62.6% for the past four months and is still below its pre-pandemic level, the prime-age group has been moving up steadily, if incrementally, and is currently at 83.5%, half a percentage point above where it was in February 2020 — just before Covid hit.”

He interviewed Rachel Sederberg, senior economist for job analytics firm Lightcast who added, “The durability of this labor market largely comes because we simply don’t have the people. We’ve got an aging population that we have to support with much smaller groups of people — the millennials, Gen X. They don’t even come close to the Baby Boomers who have left the labor market.”

Total nonfarm payroll employment gains in July increased less than the average monthly gain of 312,000 over the prior 12 months. Key industry summaries include:

Healthcare added 63,000 jobs, compared with the average monthly gain of 51,000 in the prior 12 months.

Employment in financial activities increased by 19,000 in July. The industry had added an average of 16,000 jobs per month in the second quarter of the year, after employment was essentially flat in the first quarter. Over the month, a job gain in real estate and rental and leasing (+12,000) was partially offset by a loss in commercial banking (-3,000).

In July, employment in wholesale trade increased by 18,000, after showing little net change in recent months. Employment in the other services industry continued to trend up in July (+20,000), compared with the average monthly gain of 15,000 over the prior 12 months.

Construction employment continued to trend up in July (+19,000), in line with the average monthly gain of 17,000 in the prior 12 months. Over the month, job growth occurred in residential specialty trade contractors (+13,000) and in nonresidential building construction (+11,000).

In July, employment in leisure and hospitality ticked upward (+17,000).

Employment in professional and business services as well as mining, quarrying, oil and gas extraction; manufacturing; retail trade; transportation and warehousing; information; and government showed little change over the prior month.

Halverson also noted, “Our ongoing advice to clients is to focus less on short-term economic conditions reflected in data points such as the BLS report. Instead, ensure you have a long-range talent enhancement strategy to consistently improve your team’s three C’s: culture, capability, and productive capacity.”

The U.S. labor market remains vibrant as the July U.S. Bureau of Labor Statistics (BLS) reported non-farm payroll increased by 187,000. Both the unemployment rate, at 3.5 percent, and the number of unemployed persons, at 5.8 million remained essentially flat versus the prior month.

The U.S. labor market remains vibrant as the July U.S. Bureau of Labor Statistics (BLS) reported non-farm payroll increased by 187,000. Both the unemployment rate, at 3.5 percent, and the number of unemployed persons, at 5.8 million remained essentially flat versus the prior month.